in advance of using any motion, you ought to always seek out the aid of a specialist who is aware your individual condition for information on taxes, your investments, the law, or another small business and Skilled issues that have an affect on you and/or your business.

check out our property buying hubGet pre-authorised to get a mortgageHome affordabilityFirst-time homebuyers guideDown paymentRent vs buy calculatorHow Significantly can I borrow mortgage calculatorInspections and appraisalsMortgage lender assessments

Unmarried taxpayers who declare a qualifying dependent can normally Reduce their tax charges by submitting as Head of family if they satisfy the requirements.

The tax benefit of a Roth IRA is that the withdrawals in retirement aren't taxed. You fork out the taxes upfront; your contributions are usually not tax-deductible.

You’ll also choose to ensure that you assessment all the quantities on your kinds and double-Verify your calculations.

numerous procedures for conserving on taxes require paying out cash on things that qualify for tax deductions. Contributing to the tax-deferred retirement account is without doubt one of the number of strategies it is possible to lessen your tax bill when preserving income in website your own private pocket—or at the very least within a retirement account along with your title on it.

Reinvested dividends – This a single technically isn't a deduction, however it can lower your Total tax liability. When you mechanically have dividends from mutual resources reinvested, include that within your Price foundation. using this method, when you market shares, you may decrease your taxable money get.

Tax credits for Strength-conserving property enhancements may retain more cash in the wallet All year long and at tax time.

info presented on Forbes Advisor is for academic reasons only. Your economical circumstance is unique as well as the products and services we assessment may not be suitable for the circumstances.

Putting a percentage of your revenue into investments not normally subject matter to federal profits taxes, like tax-cost-free municipal bonds, may not affect your tax photograph this 12 months, but could perhaps simplicity your tax stress when these investments start off generating revenue.

Tax attorney: A tax lawyer is an attorney who concentrates on taxation. They can symbolize taxpayers before the IRS, and also in civil and criminal tax court docket. even further, they are able to offer you tax preparing companies.

Student loans guidePaying for collegeFAFSA and federal college student aidPaying for career trainingPaying for graduate schoolBest personal college student loansRepaying scholar debtRefinancing scholar debt

The tax amount you’ll shell out on All those gains depends on just how long you held the asset along with your full taxable money. after you’ve held an asset for just one yr or considerably less, it’s a brief-time period money acquire taxed at ordinary money tax charges, ranging from 10% to 37%.

The tax benefit of a standard IRA is that the contributions may very well be tax-deductible. simply how much you can deduct relies on no matter if you or your spouse is roofed by a retirement strategy at work and exactly how much you make.

Shaun Weiss Then & Now!

Shaun Weiss Then & Now! Jenna Von Oy Then & Now!

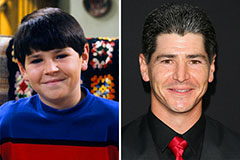

Jenna Von Oy Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!